Paytm Share Price Analysis and Insights 2024

Paytm’s share price has been a rollercoaster ride in recent times, leaving investors with mixed emotions. Let’s delve into a deeper analysis of its current standing and potential future:

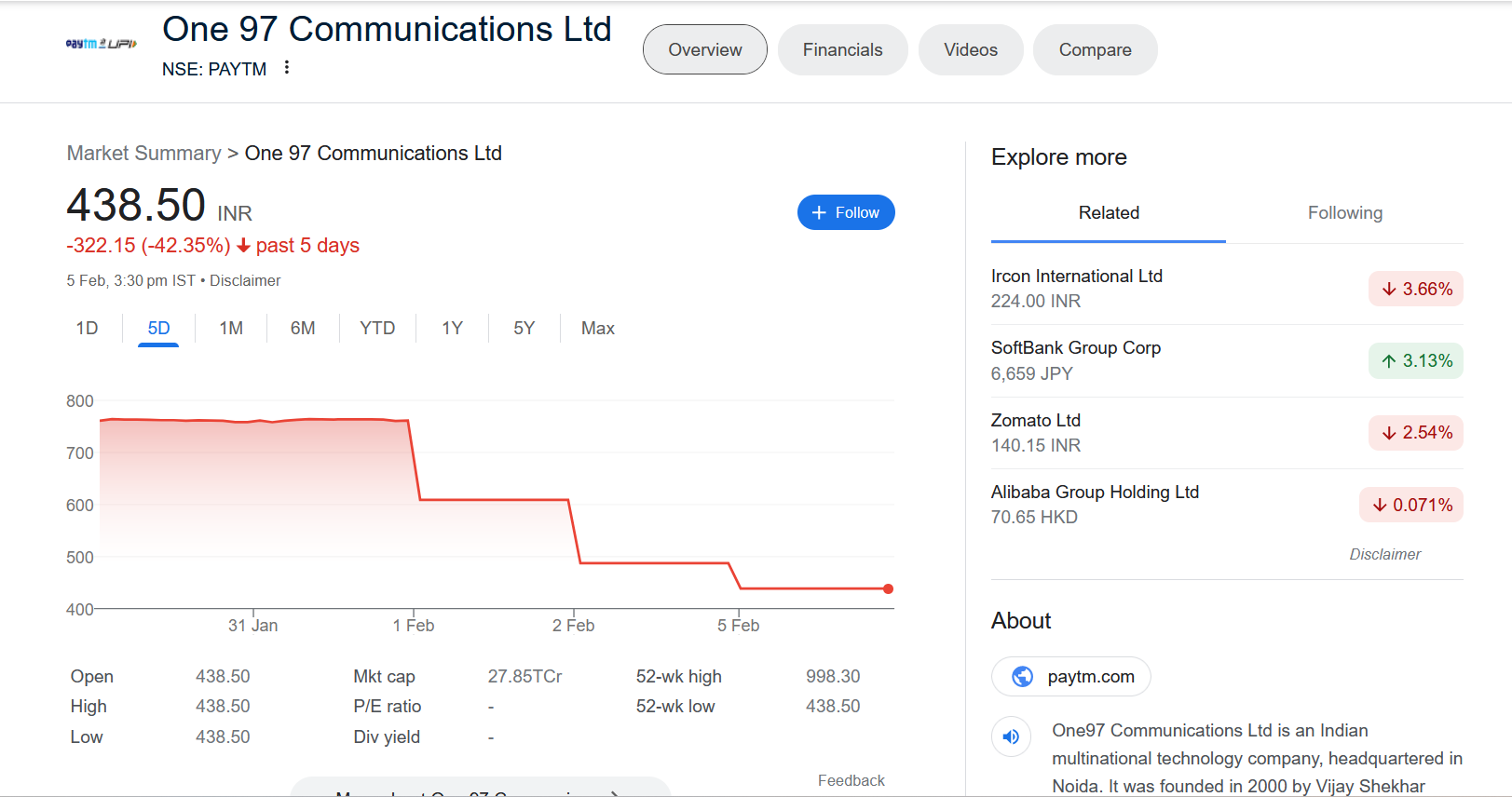

Paytm Share Price Current Situation:

- Price: ₹438, relatively flat today but significantly down from its 52-week high of ₹998.30.

- Market Cap: ₹40,768.32 Crore.

- Recent News: Focus on profitability, regulatory hurdles, expansion plans, and fierce competition.

Key Factors to Consider:

Positives:

- Large addressable market: India’s digital payments market is booming, offering significant growth potential for Paytm.

- Brand recognition: Paytm is a well-established brand with a large user base, providing a competitive edge.

- Diversification: Expanding into new sectors like wealth management and insurance could open new revenue streams.

Negatives:

- Profitability concerns: Consistent losses continue to be a major concern for investors.

- Regulatory environment: Proposed data protection and e-commerce regulations pose potential risks.

- Competition: The fintech space is crowded, with strong players like PhonePe and Google Pay vying for market share.

Expert Opinions:

- Varied: Some see current price as a buying opportunity, others remain cautious due to profitability concerns and competition.

Future Outlook:

- Uncertain: Depends on several factors, including Paytm’s ability to achieve profitability, navigate regulations, and outmaneuver competitors.

- Upcoming events: Quarterly earnings report and regulatory decisions will be crucial in shaping the future outlook.

Investor Considerations:

- High risk, high reward: Investing in Paytm carries significant risks but also offers potential for high returns if the company succeeds.

- Thorough research: Carefully assess your risk tolerance, investment goals, and conduct in-depth research before investing.

- Consider professional advice: Consult a qualified financial advisor for personalized guidance tailored to your circumstances.

Remember: This analysis is for informational purposes only and should not be considered financial advice.

Additional Insights:

- Paytm’s recent focus on profitability is a positive step, but achieving it consistently will be key to investor confidence.

- Regulatory decisions surrounding data privacy and e-commerce could significantly impact Paytm’s operations and future growth.

- The company’s success in executing its expansion plans and fending off competition will be crucial for its long-term success.

-

Paytm Facing Issues 2024: A Closer Look at the Recent Challenges